Smart Banking for Smart Business

Built for Growth. Designed for Control.

Why Business Leaders Choose Embark

Cash Management Power — Included

Get 3 free Cash Management Services, such as ACH Origination, Remote Deposit Capture, Target Sweep Account, Wire Transfers, or Online Bill Pay.

Positive Pay Fraud Protection

Safeguard your business from check fraud with Positive Pay, included at no extra cost.

No Monthly Maintenance Fee

Maintain a $50,000 average monthly balance and receive eStatements and enjoy zero maintenance fees - a smart move for businesses managing larger cash flows.

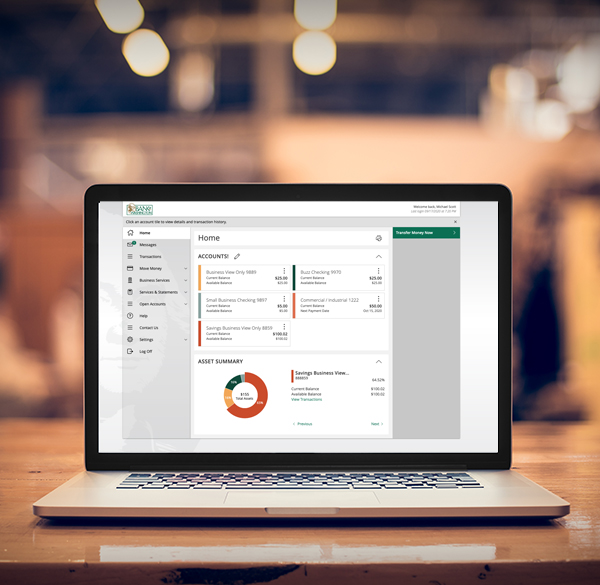

Digital Banking that Works for You

Access robust Business Digital Banking tools tailored to your operations, whether you're in the office or on the go.

Who It's For

- Established businesses managing significant cash flow

- CFOs seeking integrated financial tools and fraud protection

- Business owners who want a relationship with a local, responsive bank

Backed by a Community Bank That Gets It

Ready to Embark?

Embark Business Account Details

- 3 Free Cash Management Services

- Positive Pay

- No monthly maintenance fee with a minimum monthly average balance of $50,000 and eStatements.

- $25 minimum opening deposit

- Digital Banking

- eStatements

- Debit Card

- Account Alerts

- Daily Reporting

- Mobile Deposit

- Wire Module1

- QuickBooks® Integration

- $35 fee with a monthly average balance below $50,000

- $5 fee for paper statements

1 Wire Module provides the online service, each wire is subject to an additional wire transfer fee. Wire limits determined through a credit assessment.

Thinking About Switching? Here’s What Business Leaders Ask Most:

You can choose any 3 of the following services at no additional cost:

- ACH Origination

- Remote Deposit Capture

- Target Sweep Account

- Wire Transfers

- Online Bill Pay

Plus, Positive Pay is included.

These tools help streamline your operations and improve cash flow management.

We’re not just a bank - we’re your partner. As a locally owned, community-focused bank, we offer:

- Faster decisions made locally

- Personalized service from people who know your business

- A commitment to helping your business thrive